Property ( Real Estate ) and Power IPOs

Real Estate Burst Again!!

3rd Blog Anniversary

Here is a small cupcake in crochet to celebrate the occassion-

Telecom- the fall of tariff and stock prices

Active vs Index (Passive) Investing

Looking back! Investing is so simple.

Retail Participation in Equity IPO

OIL IPO closed today with QIB portion oversubscribed 53.83 times, NII 10.477 times, Retail 1.7642 and Employee reservation 0.267 times.

Despite a great response from QIBs, retail participation is very minimal. When we were at the peak of bull run, any IPO was getting over subscribed heavily by retail investors too. In fact, lot of demat accounts got opened before the Reliance Power issue.

This shows that Retail investors just put in their money in IPOs only based on sentiments and mostly for short term benefits.

Can we infer that retail investors are just behaving as traders based on sentiments and are yet to mature as investors?

oil allotment ratio grey market premium listing price listing date subscription

L&T Finance NCD issue open till Sep 4

OIL equity IPO which opens up on Sep 7 seems to be a good investment oppurtunity.

Shriram Transport NCD issue

Details of shriram transport issue can be found in following link :-

http://stfc.in/ncd_publicissue.asp

The other IPO that is open now for subscription is

Adani Power

10 FV

Price Range: 90 - 100

Date open :-28-Jul-09 31-Jul-09 . The company would take a long time before it starts making profits . But the issue is already over subscribed.

NHPC IPO is als0 up to come up next week which is worth considering for investment

NHPC

open date :- 07-Aug-09 11-Aug-09

Tough times do not last.

Good large cap funds to start SIP

EPF rate still @ 8.5% (2009-10)

No entry load on Mutual fund investments

Momentum is back

Its definitely time to heave a sign of relief but caution should also be the buzz word. For regular investors through SIP route , it's going to be business as usual!

The New Pension System (NPS):

Till now the unorganized sector did not have any pension plans, to enable them to save for the future. Why there was no social security system of savings out of salaries/trading income and even Provident fund scheme remained a distant dream for them. Going with the PPF , it is only organized and white collar employees had invested in PPF.

PFRDA - Looks like a great start , Good option for all

The Pension Fund Regulatory Development Authority (PFRDA) has now stipulated that only half of an individual’s savings can go into equities even if he opts for a high-risk high-return investment. The auto (default) choice for persons who do not make an investment choice also caps the equity exposure at half of the savings.

A committee chaired by HDFC chairman Deepak Parekh that advised PFRDA in framing the investment norms had recommended that risk-hungry subscribers should have the freedom to invest all their savings in equities. It had also recommended a 65% equity exposure for auto choice. Investment in stocks is considered appropriate for long-term investments such as pension plans.

PFRDA chairman D Swarup told ET that the equity exposure limit was reduced based on the recommendations of the board of trustees of the NPS and the advice of the government. “This cap would be reviewed after a year. The Deepak Parekh panel had also recommended a review of the investment pattern after one year,” he said. Besides, the world over, pension plans do not allow 100% equity investments. In the US, equity exposure is allowed in the range of 50-70%."

News of SIP taking a hit

BS Reporter / Mumbai April 28, 2009, 0:41 IST

Once the most selling product in the mutual fund industry, systematic investment plans (SIPs) are now taking the hit as investors pull out, fearing that adverse market conditions are going to continue."

RBI has changed the method by which banks calculate the 3.5 % interest rate they charge on savings bank deposits

This note comments on a point in the credit policy that has not got the attention it deserves. The RBI has changed the method by which banks calculate the 3.5 % interest rate they charge on savings bank deposits. This seemingly innocuous change has far reaching ramifications for bank bottom lines. Bank bottom lines will fall by as much as Rs 18000 crores because of this.

>From paying the interest on the lowest balance recorded from the 10th to the 30th of the month, banks will have to pay daily interest on the daily balances at 3.5%. This will result in a 25 to 50 basis point increase in the cost of savings bank funds according to the chairman of the Canara Bank.

Consider the simple example that follows:

I open an SB account with Rs 100 on January 1. Then I deposit Rs 100,000 on January 2 as I need to make (say) a mutual fund investment. The amount stays in my account till January 25, then leaves to go to the mutual fund. That leaves Rs 100 in my account on January 26. Previously I earned interest on this Rs 100 as that was the lowest amount in my bank account in the period from Jan 10 to Jan 31. Now the bank will have to pay me interest on Rs 100,000 for the period from Jan 2 to Jan 25. !!!

As mentioned, this will result in a 25 to 50 basis point increase in the cost of funds in savings banks, according to the chairman of the Canara Bank. Now there are 36 LAKH CRORES in savings accounts in India according to the RBI.

That means banks net interest margins (and consequently profits) will reduce by Rs 9000 crores EVEN if we take the impact at the lower 25 basis points. At 50 bps, the impact is 18000 crores.

Savers benefit by this amount and banks lose by this amount.

Sites offering tips for money

Future of IT?

The next big problem would be exchange rate.The dollar may start weakening in a couple of years getting back to the trend it was a year ago.If this happens it will start having an impact on the revenues again.IT stock were multi-baggers in the late 90s and earlier part of this decade.

Good Lessons to learn from Millionaires

Living below means and Avoiding debt in life are the two best suggestions.

http://finance.yahoo.com/news/10-Secrets-of-Millionaires-usnews-14921158.html;_ylt=Arg3qX__o1jqHtQxFcRdSs4Jo9IF

Back to Savings habit in US!!

Lof of articles on savings and investment ( sample ) have started popping up in yahoo finance, msn finance,etc. These articles are more in the US context .

Consumerism has just started in India and we still maintain a great savings culture. But a part of working class esp . young urbans who started of with great salary in the last couple of years , need to realise the value of living within the means. Value for money is not something that we should look for in a tough time. But it should be practiced all the time so that it becomes a shared nature. Buying any liabilities in the name of assets paying huge EMIs should also be avoided.

At least a part of the money earned should be made to work for future by investing appropriately.On the contrary consuming tomorrow's money for today need to be avoided.

The age old thoughts of being frugal, saving and investing would always help tide any economic or financial crisis.

SIP - to be discontinued now???

It may take a couple of years for economies to come on track. Funds will start automatically flowing into markets then. So, if you wait for a perfect day to invest you might loose the bus.

So continue your SIP for long term investment goals and reap the benefit.

http://valueresearchonline.com/story/h2_storyview.asp?str=12990

Tap the midcap potential

Midcap stocks normally offer huge opportunities for growth. In a bear market they are prone to more downside too. But risk is always proportionate to return.

Of late, I have seen a lot of advises to ride mainly on large cap stocks to avoid great losses. Large caps are definitely safe bets. But for those who want to take that extra bit of risk, midcaps offer a great opportunity. Not all midcaps grow to become large caps .So it's better to invest through a midcap fund for diversification and use the research of fund houses. It's also a good idea to invest directly in mid cap stocks based on the portfolio of some good mid caps fund with a great track record.

BSE midcap is currently trading at a P/E of around 8 when compared to BSE Sensex P/E of around 11 .( Check BSEINIDA site for online data). BSE midcap index has fallen to almost 2600 levels from peak level of 10000. i.e almost 75% fall from the peak. This shows that there is a limited downside while there is huge potential upside in the long run.

Reliance growth, Sundaram Select Mid cap, Birla Mid cap, Kotak opportunities are some good midcap funds where an investor may start investing systematically to reap the benefit in a 5-7 year horizon. Alternatively one can also start accumulating ETFs like Juniorbees directly through DMAT account with a long term investment perspective.

Golden time to start an SIP

Reality Talk

Should we invest in TATA capital non-convertible secured debentures

Tata Capital is a Non-Deposit taking Non Banking Financial Company (NBFC). It encompasses several areas of operations like Personal/Auto Loans, SME/Infrastructure Finance, Wealth Management, Investment Banking, Private Equity and Treasury Advisory. This enables it to get fund and fee based income.

Attractive Interest Rates : 11% for the monthly option, 11.25% for the quarterly option and 12% for the annual or cumulative option.

At these turbulent times…..Focus on Cost *

Well, How do we do it?

There are many ways to do it. One good way is through Microsoft Money Plus (Deluxe). MS Money is an excellent software to manage your personal finances. One amazing feature it provides is the cash flow forecast for your bank account. The forecast would be based on your recurring deposits (for a salaried person, it would most probably be only the monthly salary) and all the recurring expenses.

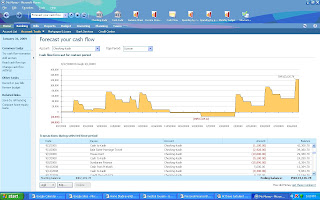

Fig: A sample Cash flow Forecast

How it helps?

Once you start tracking your day-to-day financial transactions in MS Money and also setup your Recurring Deposits and Expenses, you will be easily able to answer ALL the below questions through the Cash flow Forecast feature.

1) Will I have sufficient Money for my sister’s Marriage in January, 2010?

2) What if I get a salary decrease of 10%, would I still be able to sustain my increasing house rent?

3) How much money would I have saved in June 2010 considering I pay Rs.1000 less on my home loan EMI starting this month?

4) How much of monthly expense should I reduce to afford an additional Car EMI?

and lot more…

Well, Isn’t that a lot of time and effort tracking? Is it all really worthwhile???

All its takes is just10 mins everyday to track your expenses. What you get? You get to understand your finances and have it under YOUR control.

Is that all that MS Money has to offer? No!

MS Money also allows you to

1) Understand how much money you have in all your accounts inclusive.

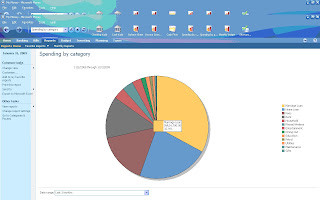

2) Understand where all your hard-earned money is going through user-friendly reports like Expenses by Category/Payee etc…

Fig: A Sample Spending by Category (Pie-Chart)

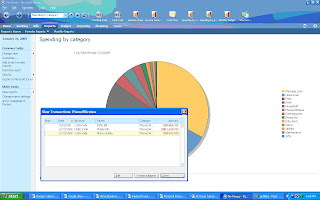

3) You can easily understand why you have spent Rs.12,500 on Dining Out this month. Just double-click on the category and get the break-up. If you need to change it, change it there itself.

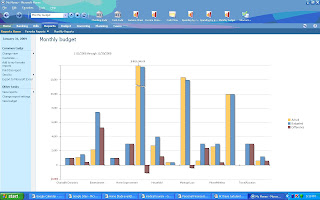

4) Budget your expenses and get alerted whenever your expenses go over-budget.

Fig: A Sample Budget chart

5) Get alerted of the pending Bill Payments.

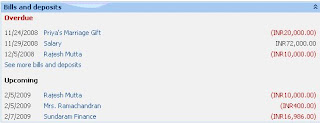

Fig: A Sample Bills and Deposits Chart (Also get reminders when you start your PC)

6) Get your monthly Income and Expense Statements and also a month-wise Comparative analysis. You can also calculate your Net Worth just through a button click

Other than these, there are loads of other easy to use features. Just go ahead, explore and have fun!!!

Download the 60 day trial version from the below link:

http://www.microsoft.com/money/ProductDetails.aspx?pid=003

PPF vs POMIS

An interesting read

Sensex Prediction

When I read the following article in 2005, I thought it was a complete bluff. As 18000 was a figure that was predicted for sensex in 2010. I had book marked this article and somehow lost it when my machine was formatted.

However, this article was fresh in my memory when sensex actually crossed 18k and 20k in 2007. I badly searched for the article I had read, but couldn't spot it. After a long fight ( may be my Internet searching skills are poor), I got the link back.

You may find it an interesting read!!! One of the rare things that happened..a prediction come true in the stock market!!! hope the author is not a professional analyst!.

US dollar - the way ahead

Income tax investment not an year end exercise

2000 vs 2008

Should we invest in stocks at all??

Money and happiness

Simple Indian Food - Feel @home ( Best veg food blog )

Disclaimer

Feel free to mail your queries/ comments to ideas.money@gmail.com